Exploring UK Intestacy Rules: What Happens Without a Will?

Losing a loved one is a deeply emotional experience, and when there’s no will to guide the distribution of their estate, it can lead to confusion and uncertainty for those left behind. In the UK, intestacy rules come into play when someone passes away without a valid will. Let’s delve deeper into this topic to understand the implications and importance of estate planning.

The Impact of Intestacy

Intestacy occurs when a person dies without a will or when their will is deemed invalid. In such cases, the deceased’s estate is distributed according to legal guidelines rather than their personal wishes.

Distribution of Assets Under Intestacy

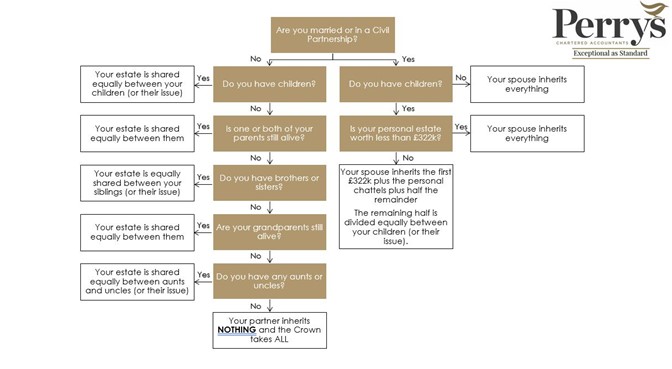

The distribution of assets under UK intestacy rules depends on the deceased’s family structure:

- Married/Civil Partnership with Children:

The spouse or civil partner inherits:

All personal belongings.

The first £322,000 of the estate.

Half of the remaining estate.

The other half of the remaining estate is divided equally among the children.

- Married/Civil Partnership with No Children:

The spouse or civil partner inherits the entire estate, including personal belongings.

- Unmarried with Children:

Children inherit the entire estate equally.

- No Surviving Spouse/Civil Partner or Children:

The estate may pass to parents, siblings, or other relatives in a specific order of priority defined by law.

Here is a visual representation of the above in the form of a flowchart.

Reasons for putting a will in place

Creating a will is essential for several reasons:

Control: Having a will gives you control over the distribution of your estate after your passing. By clearly outlining your wishes in a legally binding document, you can specify who should or should not inherit your assets, how they should be distributed, and even appoint guardians for minor children if necessary. This control ensures that your estate is managed according to your preferences, providing peace of mind during your lifetime and beyond.

Clarity: A will can provide clarity for your loved ones regarding your intentions and wishes. Without a will, the distribution of assets can be subject to intestacy rules, which may not align with your family dynamics or desires. A well-drafted will clearly outlines who should inherit specific assets, reducing confusion and potential disputes among beneficiaries. Clarity in your will ensures that your loved ones understand your wishes and can carry them out efficiently.

Faster Probate process: With a valid Will in place, the appointed executor follows the instructions outlined in the Will, which can expedite and simplify the probate process. Without a Will (intestate), the court may need to appoint an administrator and distribute assets accordingly, which can be more time-consuming and costly.

How Perrys can help

Perrys offers comprehensive estate planning services tailored to your needs:

Drafting and execution: We will draft your will professionally, guiding and explaining you through the process all the way and providing details around signing to ensure it is valid and legally binding.

Inheritance tax planning: We can assist in structuring your estate, where necessary, to minimise tax liabilities and protect your assets.

Secure storage: We also offer free secure storage for your will, ensuring it remains safe and easily accessible when needed and providing copies for your own records.

Taking control of your legacy

Don’t leave the distribution of your estate to chance. Contact Perrys today to discuss your estate planning needs and take control of your legacy. Whether you’re considering creating a will for the first time or updating an existing one, our dedicated team is here to assist you every step of the way.

Conclusion

Understanding UK intestacy rules is crucial, but having a will in place is even more important to ensure your estate is handled according to your wishes. By working with Perrys, you can navigate the complexities around estate planning, especially in will writing with confidence and ensure that your loved ones are provided for after you’re gone.

Take the proactive step of securing and protecting your legacy today. Contact Perrys for a consultation and start the process of creating a will that reflects your desires and safeguards the interests of those you care about most. With Perrys’ expertise and support, you can approach estate planning with peace of mind.