Dividends paperwork – Are you compliant?

Dividends can be voted and distributed to shareholders of a Limited Company from distributable retained profits within the business.

Many owner-managed companies pay dividends to their director/shareholders in addition to a salary. Currently dividends are taxed more favourably than PAYE income on an individual.

Dividends cannot be declared by a company unless there are available, distributable profits at the date of the dividend.

Dividends currently are free from income tax on the first £1,000 for 2023-24 which will be dropping to £500 in 2024-25. Dividends above this amount will be taxed on an individual at 8.75% for a basic rate taxpayer, 33.75% for a higher-rate taxpayer and 39.35% for an additional rate taxpayer.

Dividends should be supported by relevant documentation to validate the amounts declared as dividends.

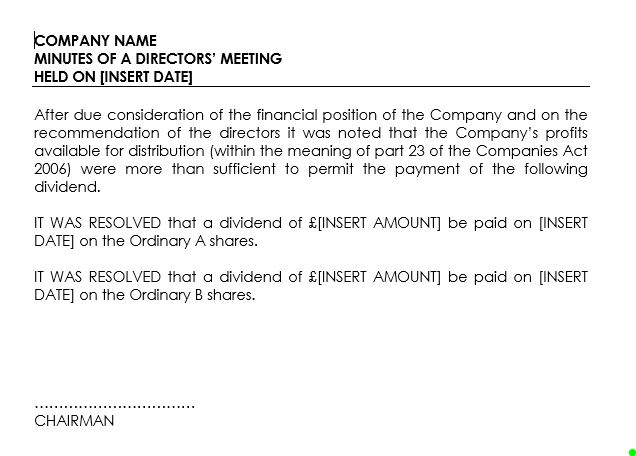

Minutes

Before a dividend is paid, a directors meeting should be held to consider whether there are sufficient retained profits on which to declare the dividend. The decision is then recorded within the Minutes of the meeting. An example of typical Minutes that could be used to formally declare a dividend on a share class can seen below;-

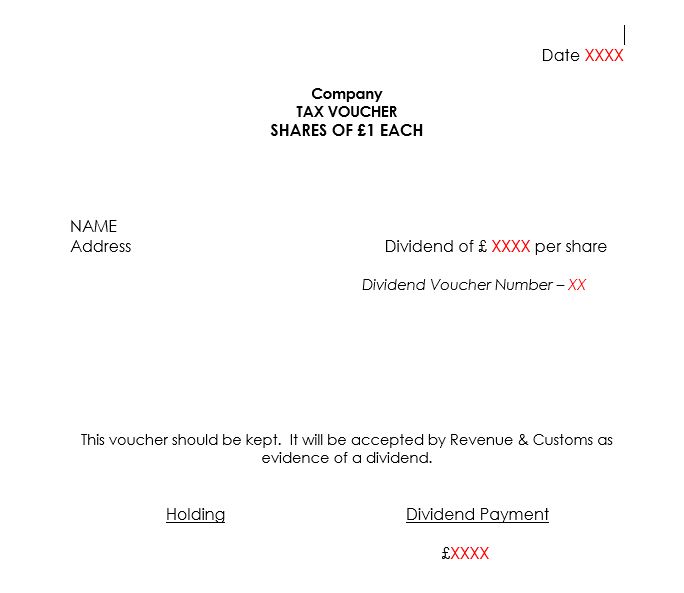

Dividend Voucher

As well as holding a meeting and keeping Minutes of the decision, a dividend voucher must also be prepared and provided to each shareholder for their retention, either electronically or as a hard copy. The dividend voucher should include the following information:

- 1 – Date

- 2 – The name of the Limited Company and Company number

- 3 – Shareholder name

- 4 – Share class the shareholder holds

- 5 – Number of shares held

- 6 – Amount paid per share

- 7 – Dividend paid

This voucher must be given to recipients of the dividend and a copy must be kept for the company records.

An example of a dividend voucher:-

If you would like to discuss further the above requirements to support dividend payments or wish to review your company or personal tax affairs, please contact your local Perrys branch.